irs pay taxes

Make an IRS payment with a credit card. Dont Wait Until Its Too Late.

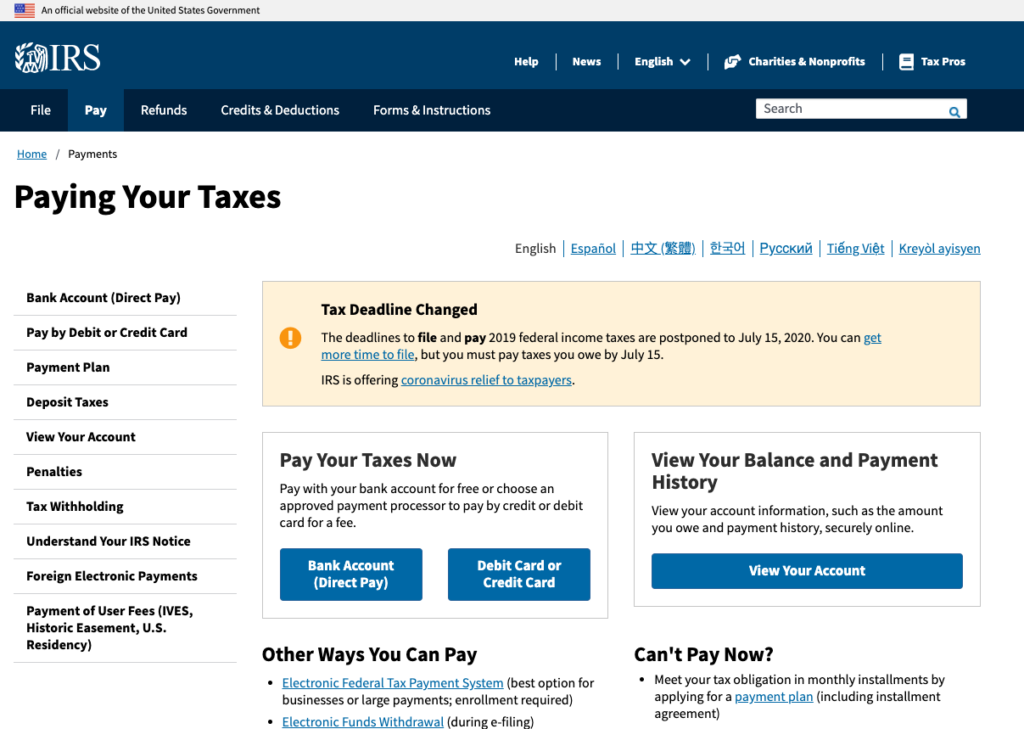

Irs Tax Payment Tips On How To Pay Online Before 15 July Deadline As Com

Debit card convenience fee.

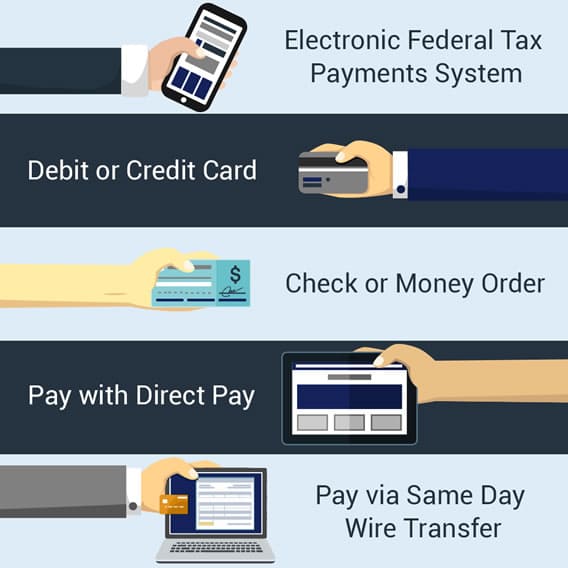

. Select Form 1040ES if you are making an estimated tax payment. Make an IRS payment with a same-day wire transfer. Department of the Treasury.

Resolve your past due tax issues permanently. You usually receive a Form 1099-K if you make more than 20000 and provide at least 200 trips. Estimated tax is the method used to pay tax on income generally reported on your Form 1040 1040A or 1040EZ that is not subject to withholding for example earnings from self.

Make A Personal Payment. This webinar will give an overview of Field Collection program including Common causes of businesses accruing employmentpayroll taxes the risks of using a 3rd party to handle employmentpayroll taxes tools the employer can use to monitor their own compliance and limit risks and much more. Free preparation for 2020 taxes.

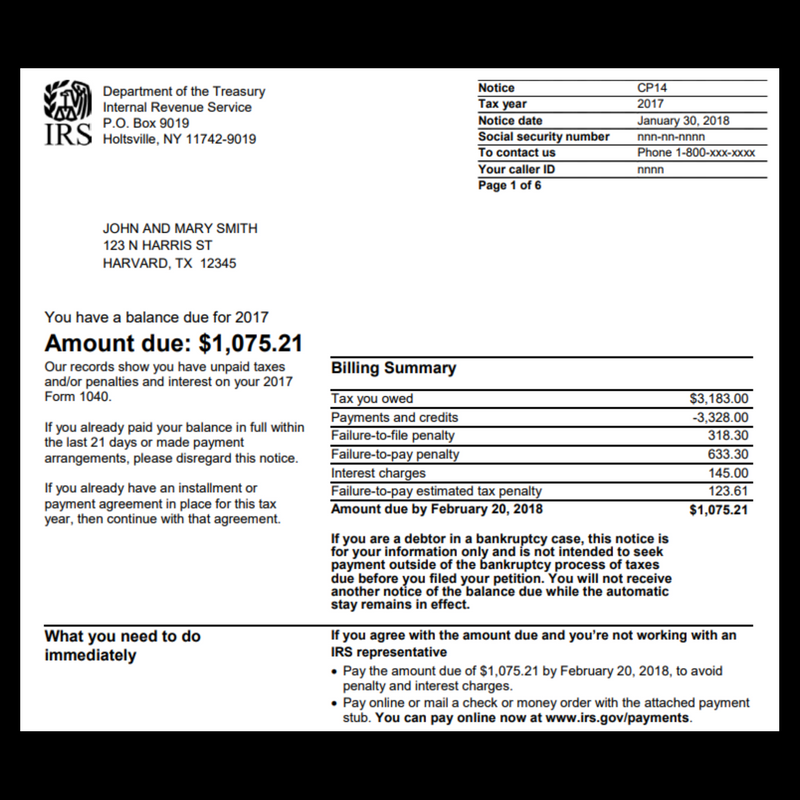

The IRS will charge a late filing penalty a late payment penalty and interest on any unpaid balance you owe if you dont file your return or an extension on time and if you also fail to pay on timeBut youll at least avoid the late-filing penalty if you file an extension by the April due date which is a hefty 5 of the taxes you owe for every month your return is late. An IRS payment plan is an agreement you make directly with the agency to pay your federal tax bill over a certain amount of time. Get Free Competing Quotes For Tax Relief Programs.

Fees for IRS installment plans. 2020 Estimated Tax Payments Taxpayers making their 2020 estimated tax payment by check money order or cashiers check should include the appropriate Form 1040-ES payment voucher. IRS Tax Tip 2018-87 June 6 2018 The IRS offers several payment options where taxpayers can pay immediately or arrange to pay in installments.

100 Money Back Guarantee. Pay your IRS income tax with PayPal. An extension of time to file your return doesnt also extend your time to make payment.

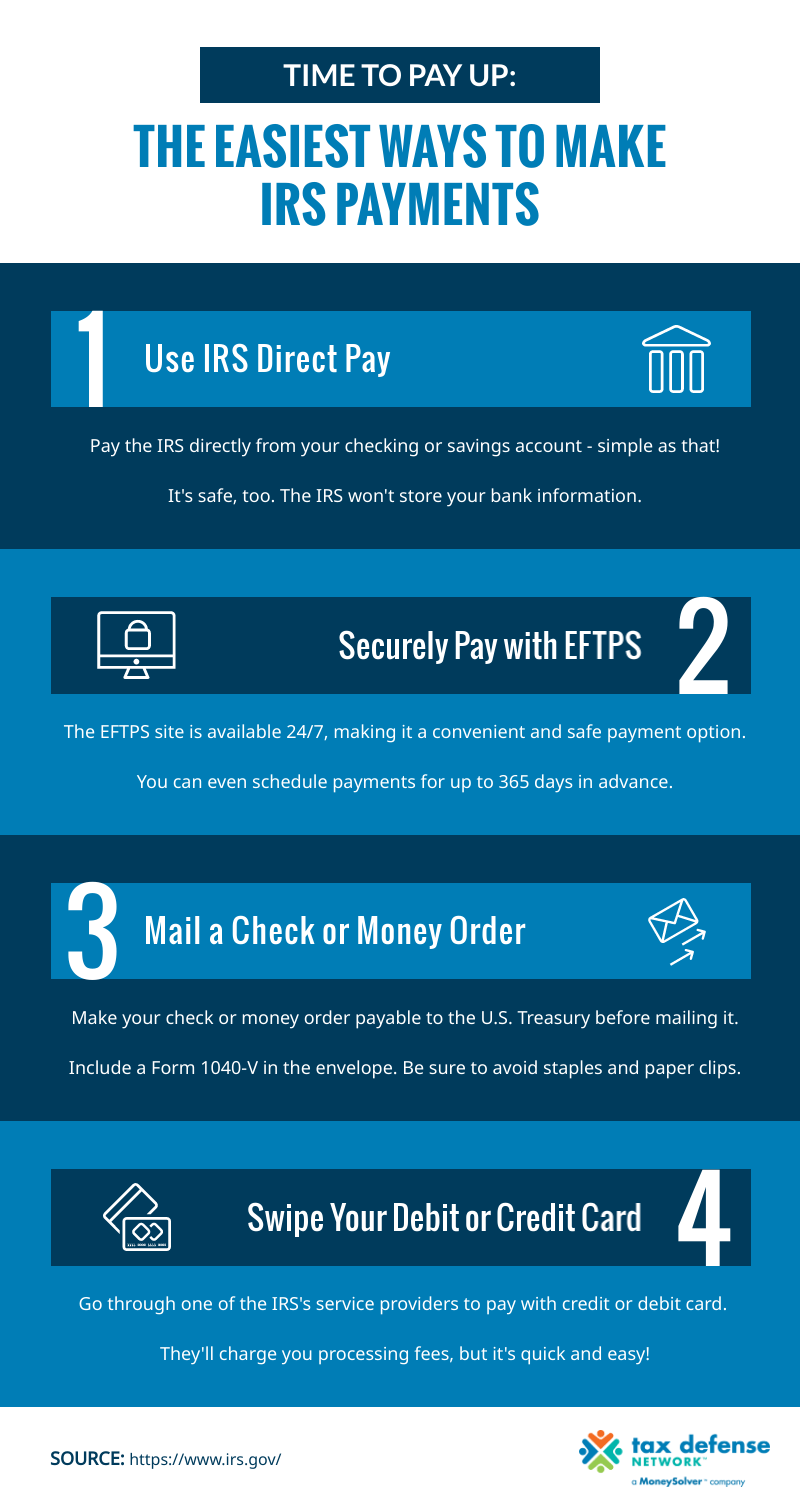

Here are some ways to make payments. Make an IRS payment with a debit card. The trusted and secure way to make business tax return payments to the IRS with your credit or debit card for a low fee.

Maryland state income tax rates range from 2 to 575. There are two kinds of IRS payment plans. After youve enrolled and received your credentials you can pay any tax due to the Internal Revenue Service IRS using this system.

2020 Federal Tax Filing Free Federal IRS 2020 Taxes. Learn Maryland tax rates for income property sales tax and more so that you can estimate how much you will pay on. If you cannot pay off your balance within 120 days setting up a direct debit payment plan online will cost 31 or 107 if set up by phone mail or in-person.

THE FOLLOWING DEADLINE FOR TAX FORMS PAYMENTS AND EXTENSIONS IS DUE ON OR BEFORE APRIL 18. Tax payments are due by the filing deadline. Official Payments makes it easy to pay IRS 1040 taxes Installment Agreements Prior Year and other federal taxes using your favorite debit or credit card.

This system is solely for paying Federal tax payments and not State tax payments. Ad Honest Fast Help - A BBB Rated. Find Out Free Today.

For more information go to Pay by Check or Money Order on IRSgov. Other tax forms you may need to file crypto taxes The following 1099 forms that you might receive can be useful for reporting your crypto earnings to the IRS. Its fast easy secure and your payment is processed immediately.

Ad File federal prior year 2020 taxes free. Use your credit or debit card to pay personal or business taxes. Pay Your Federal Taxes Online.

A convenience fee will apply. If you can pay off your balance within 120 days it wont cost you anything to set up an installment plan. Taxpayers should not ignore a bill from the IRS because as more time passes interest and penalties accumulate.

Ad Reduce Or Even Legally Eliminate IRS Debt With New Settlement Prgms. The Electronic Federal Tax Payment System tax payment service is provided free by the US. Tax Day is April 18 in 2022.

You will likely receive two tax forms from Uber or Lyft if you meet certain requirements. The Electronic Federal Tax Payment System EFTPS 3. Provide Your Tax Information.

The IRS provides internet options for payment or you can visit one of its retail partners or mail your payment in the good old-fashioned way. This includes the payment type applicable form number and tax period. You may even earn rewards points from your card.

Form 1099-K reports driving income and Form 1099-NEC reports any income you earned outside of driving including incentive payments referral payments and join and support payments. For example to pay the balance due for a 2020 income tax return youll select the Tax Return or Notice option from the Reason for Payment drop-down box. Indicate on the check memo line that this is a 2020 estimated tax payment.

Short-term and long-term. Get free competing quotes from the best. Ad Dont Let the IRS Intimidate You.

Irs Payment Plans Installments Ways To Pay E File Com

Payments Internal Revenue Service

How To Make Irs Payments For Your Taxes Tax Defense Network

Irs Notice Cp503 Second Reminder For Unpaid Taxes H R Block

Irs Direct Pay One Of Many Ways To Pay Estimated Taxes Don T Mess With Taxes

Tax Balance Due 3 Steps To Address Irs Notice Cp14 Tax Defense Network

Irs Payment Options How To Make Your Payments

How To Pay The Irs Online Pay Income Taxes Pay The Irs Taxes Online By Mail Pay 1040 Online Youtube

0 Response to "irs pay taxes"

Post a Comment