how to withdraw kiwisaver

KiwiSaver Contribution Holidays. You only need to apply to us if youre within the first 2 months of your KiwiSaver membership.

If you are a member of a complying fund you may be able to withdraw your savings to help you buy your first home.

. If you are suffering from certain life-shortening congenital conditions you may be able to make an early withdrawal from your Westpac Kiwisaver Scheme account. Ad Download Or Email KiwiSaver More Fillable Forms Register and Subscribe Now. Eligible members can withdraw their KiwiSaver savings including tax credits.

Getting my KiwiSaver funds at 65. Westpac KiwiSaver Scheme Fund Chooser. It cannot be used to buy an investment property.

Withdrawing the full amount from your KiwiSaver usually takes 5-10 working days but could take as long as 15 working days if final government contributions need to be claimed from IRD. First home withdrawal form PDF 6219KB. Contact your KiwiSaver provider when you turn 65.

If youve been a KiwiSaver member for less than three months you need to contact Inland Revenue to apply. Contact your scheme provider for the correct form to complete to make a hardship withdrawal. Other factors to consider.

If your application is accepted you can only withdraw your and your employers contributions. You have to leave 1000 in your account and you have to live in the property not rent it out. Use the online tool to find out what financial support you could access.

Double check all the fillable fields to ensure full precision. Moving to any other country After youve been living overseas not Australia for 1 year you can take most of the savings from your KiwiSaver account. However at least 1000 must remain in their KiwiSaver account.

KiwiSaver is a voluntary savings scheme to help set you up for your retirement. They can take you through the process. If you joined on or after 1 July 2019 you will be eligible to withdraw when you turn 65.

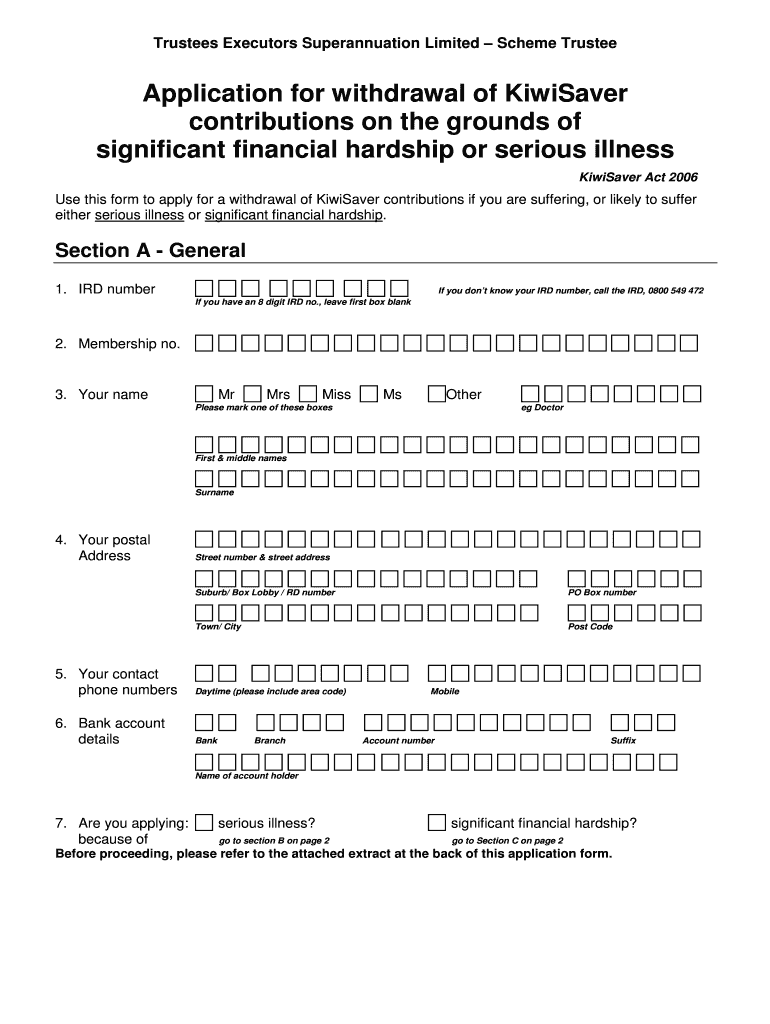

To withdraw funds you will need to provide evidence you are suffering significant financial hardship. KiwiSaver first home withdrawal application - online form. Getting your KiwiSaver funds.

Getting my KiwiSaver funds for other reasons Bankruptcy relationship property paying tax liability and your KiwiSaver when you die. Figure out how much you should be saving for retirement here. If you turn 65 and keep working you can still pay into your KiwiSaver account if you joined KiwiSaver before 1 July 2019 and youve have been a member for less than 5 years.

What is the process for a KiwiSaver retirement withdrawal. Use our calculators below to check your fund. You would need to provide an eligibility letter from Kāinga Ora showing that you qualify for a KiwiSaver first home withdrawal.

There are two options available to submit a retirement withdrawal from your KiwiSaver account. The Deceased Estate Withdrawal Application Form needs to be downloaded completed and returned. You can make regular contributions from your pay or directly to your scheme provider.

If you didnt withdraw from KiwiSaver during the initial 8 weeks and the IRD wont accept your reasons for late opt out then the only other option you have to avoid paying the KiwiSaver contributions is to apply for early repayments holiday. Otherwise you can contact your KiwiSaver provider. You can contact Kāinga Ora by either visiting wwwkaingaoragovtnzfirsthomegrant or calling 0508 935 266.

C Collect the documents in the checklist on page 5 and send to us by email or post. The government contribution interest you have earned. First home withdrawal Australian super allows you to use funds transferred from KiwiSaver towards a first home purchase.

Submit the request online by logging into myKiwiWealth or. As your circumstances and earnings change it pays to check your fund is still the best match for where your lifes at now and where you want to go. There is no entryexit tax on superKiwiSaver funds transferred between AU and NZ.

Getting my KiwiSaver for health reasons You may be able to withdraw some or all of your KiwiSaver funds early if your health permanently affects your ability to work or you could die. If you decide to access your KiwiSaver funds when you turn 65 you can decide to withdraw some or all of the money held. Omplete the initial retirement withdrawal form.

Once you have contributed for a period of 3 years you can withdraw your KiwiSaver funds to go towards your first home. If youve been affected by COVID-19 Work and Income may be able to help. You must intend to live in the property.

To submit a request online click the Withdraw button when logged into the portal. Check or change your fund. Contact your KiwiSaver provider if you decide to transfer your KiwiSaver funds.

Your contributions your employers contributions. You must be in KiwiSaver for at least 3 years before you withdraw funds for your first home. Talk to your KiwiSaver provider and Kāinga Ora - Homes and Communities about buying your first home.

Once we have received your withdrawal application and all required information we will make a payment directly to your. Aside from the potential benefits listed above it may also pay to consider some other factors. You can login to Westpac One online banking to check or change your fund.

When you reach the age that youre eligible to withdraw your funds contact your KiwiSaver provider. You are entitled to withdraw from your KiwiSaver account when you reach the qualification age for New Zealand Superannuation currently 65 or five years after joining KiwiSaver whichever is the later if you joined before 1 July 2019. Apply a check mark to point the choice where necessary.

Just complete our simple online form and well be in touch. Use the Sign Tool to add and create your electronic signature to signNow the. Or download complete and return a copy of the KiwiSaver first home withdrawal application form.

You cant withdraw any Government contributions. Complete a standard withdrawal form and provide some supporting documents. Enter your official identification and contact details.

How To Withdraw Your Kiwisaver Early Glimp

First Home Or Second Chance Home Withdrawal Form Superfacts Com

Kiwibank Kiwisaver Withdrawal Form Fill Online Printable Fillable Blank Pdffiller

Asb Kiwisaver Withdrawal Form Fill Online Printable Fillable Blank Pdffiller

0 Response to "how to withdraw kiwisaver"

Post a Comment