gordon growth model

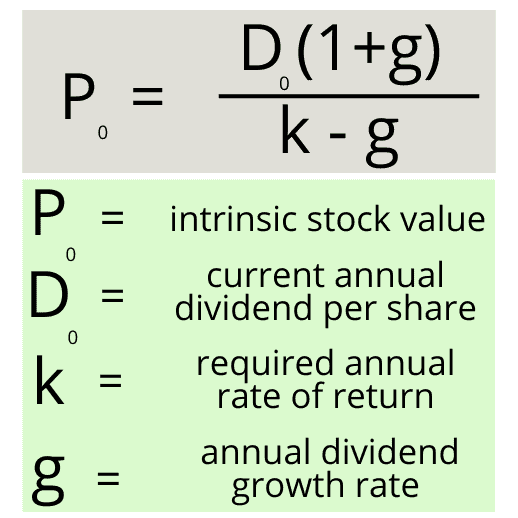

Gordon Growth Model Formula is used to find the intrinsic value of the company Find The Intrinsic Value Of The Company Intrinsic value is defined as the net present value of all future free cash flows to equity FCFE generated by a company over the course of its existence. It takes the dividend payment at the time and also looks at its expected dividend growth rate over a specific time to.

Session 6 Dividend Discount Model Constant Growth Gordon Growth Model Youtube

As per the Gordon growth Formula Gordon Growth Formula Gordon Growth Model derives a companys.

. And finally you add the present value of your company DEF future dividends to get the intrinsic value of the. The Gordon Growth Model GGM helps an investor to determine the intrinsic value of a stock based on the constant rate of growth of its future dividends. Introduction to Gordon Growth Model.

And after that we apply the Gordon Growth Model formula to determine the value in the fifth year. This model uses three inputs ie. The Gordon Growth Model can be an effective way to analyze stocks but like most financial predictors it has its pros and cons.

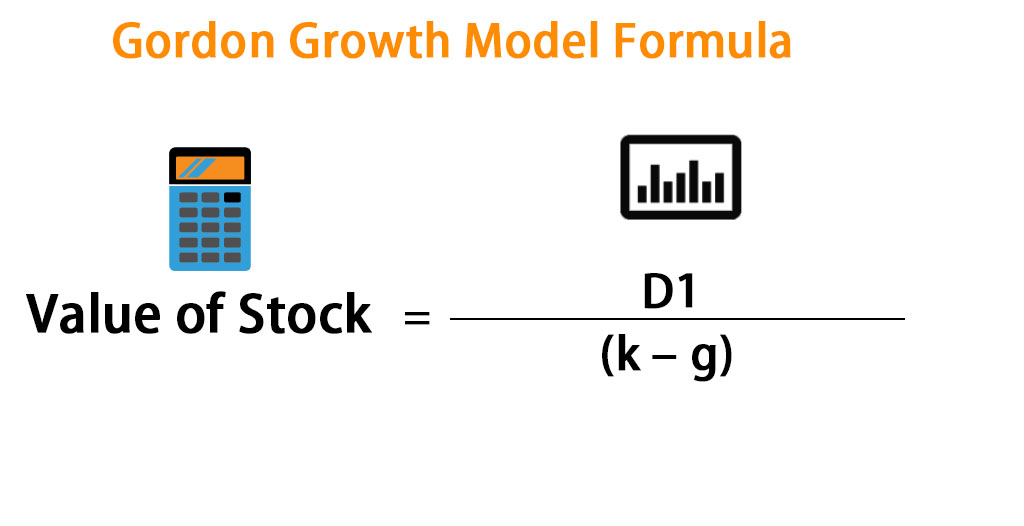

The Gordon growth model is a relatively simple formula. The Gordon Growth Model is used to calculate the intrinsic value of a dividend stock. Stock price dividend payment in the next period cost of equity - dividend growth rate The advantages of the Gordon Growth Model is that it is the most commonly used.

2780 110 5 1726. As such it is advisable to purchase the stock of ABC Ltd as the market. Gordon Growth Model GGM the most used variant of the Dividend Discount Model DDM is a valuation method that is used to calculate the intrinsic value IV of a stock.

Gordon Growth Model Calculator. The Gordon Growth Model is also called the dividend discount model is a kind of valuation of stock methodology where one uses it to calculate the intrinsic value of the stock and this model is very useful because it eliminates any externals factors like prevailing market conditions. Value of stock D1 k g Value of stock 2 9 6 Value of stock 6667.

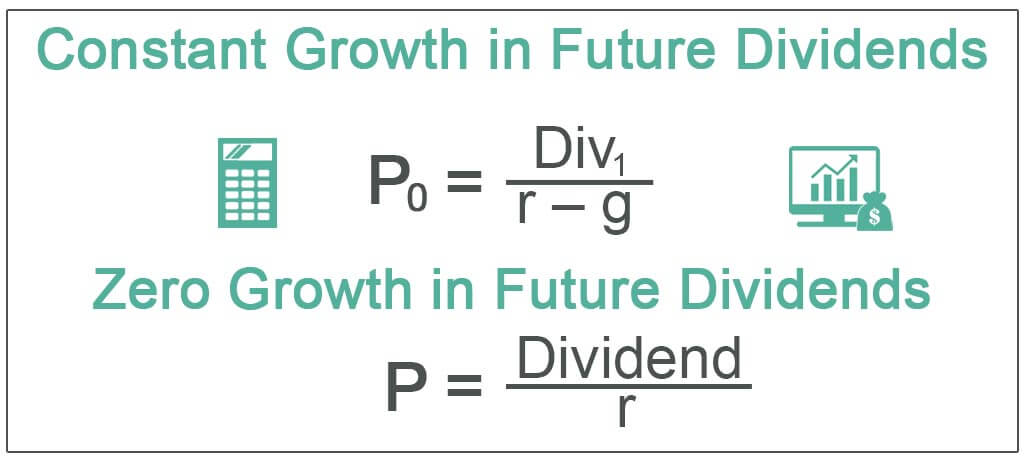

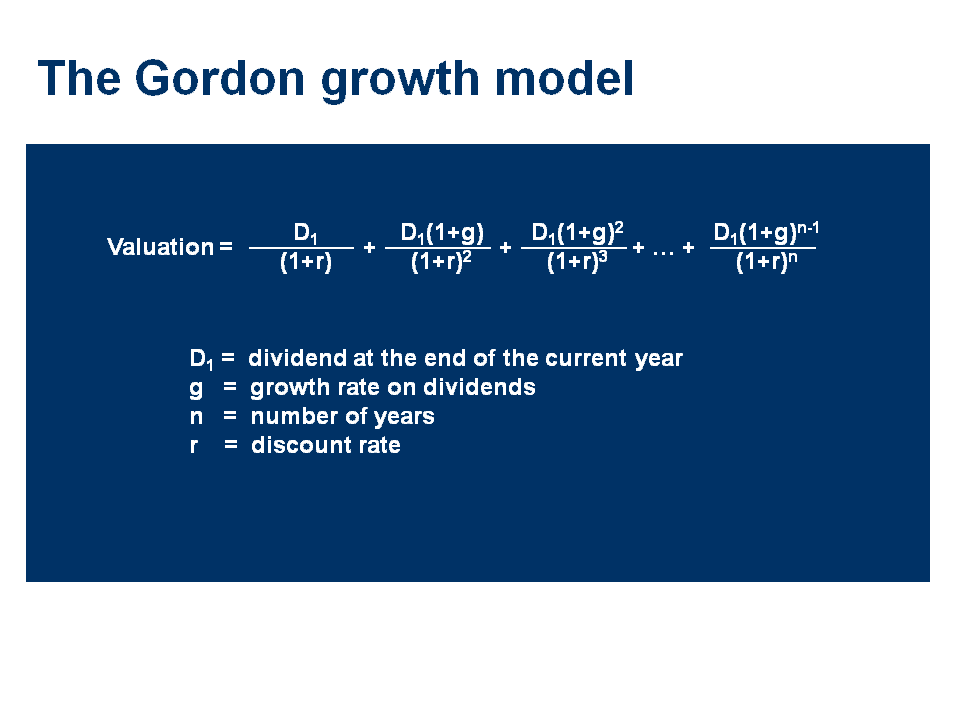

139 010 005 2780. The Gordon growth model like other types of dividend discount models begins with the assumption that the value of a stock is equal to the sum of its future stream of discounted dividends. Divided by the difference between an investors desired rate of return and the stocks expected dividend growth rate.

Gordon Growth Model. The constant-growth form of the DDM is sometimes referred to as the Gordon growth model GGM after Myron J. The constant growth rate of the dividend g is the expectation of growth in the future.

It reflects the true value of the company that underlies the stock ie. Gordon Growth Model is a model to determine the fundamental value of stock based on the future sequence of dividends that mature at a constant rate provided that the dividend per share is payable in a year the assumption of the growth of dividend at a constant rate is eternity the model helps in solving the present value of the infinite. Gordon Growth Model Formula.

What is the Gordon Growth Model. Stable Growth Model or Gordon Growth Model. To a financial service firm.

For our example we will use the 6 previously mentioned. Put simply the Gordon Growth Model uses a companys rate of return and its dividend growth to. The Gordon growth model formula is shown below.

Morgan A Rationale for using the Gordon Growth Model As a financial service firm in an extremely competitive environment it is unlikely that JP. Under the right conditions the Gordon Growth Model is a useful tool for understanding the relationship between valuation and return. Morgans earnings are going to grow.

Eventually the company will grow at a rate less than that and return to earth and grow at a rate equal or less than the. Use this calculator to determine the intrinsic value of a stock. Advantages of the Gordon Growth Model.

The Gordon Growth Model is a great way to determine a fair price for a stock. Gordon of the Massachusetts Institute of Technology the University of Rochester and the University of Toronto who published it along with Eli Shapiro in 1956 and made reference to it in 1959. The model assumes that the stock pays an indefinite number of dividends that grow at.

In simple terms the Gordon Growth Model calculates the present value of a future series of. The present value of the stable period dividends are then calculated. The Gordon Growth Model GGM is a popular model in finance and is commonly used to determine the value of a stock using future dividend payments.

Gordon growth model is a type of dividend discount model in which not only the dividends are factored in and discounted but also a growth rate for the dividends is factored in and the stock price is calculated based on that. Stock Price D 1g r-g where D the annual dividend. It is most commonly used as part of discounted cash flow DCF analysis where it is used as an alternative to the exit multiple method of determining the terminal value TV.

The growth rate in earnings and dividends would have to be 312 a year to justify the stock price of 3000. Using the formula of the Gordon growth model the value of the stock can be calculated as. Therefore the intrinsic value of the stock is higher than the market value of the stock.

G the projected dividend growth rate and. It is calculated as a stocks expected annual dividend in 1 year. As our company grows it becomes more difficult to maintain that growth.

For example say a company expects to pay 250 a share in dividends over the next year has a long track record of increasing its dividend. The model is named after Myron Gordon an American economist who popularized this model in the 1960s.

Cima F2 Gordon S Growth Model Youtube

Gordon Growth Model Formulas Calculation Examples

Gordon Growth Model Guide Formula 5 Examples Dividends Diversify

Gordon Growth Model Formula Calculator Excel Template

Gordon Growth Model Prepnuggets

Understanding The Gordon Growth Model For Stock Valuation Magnimetrics

Gordon Growth Model Formula Tips Reviews Dividend Mantra

Gordon Growth Model Complete Guide To The Gordon Growth Model

0 Response to "gordon growth model"

Post a Comment